Trusts vs. Wills: What’s Best for Your Family’s Estate Planning?

Trusts versus wills is a key question in estate planning. You need to weigh what your family needs. You need to assess your assets. You need to understand how will vs trust Malaysia issues will play out.

Estate planning is crucial for everyone, not just the affluent, to ensure their assets are distributed as they wish after their passing. In Malaysia, a comprehensive estate plan often involves both a living trust and a will. These two tools, while distinct, are most effective when used in conjunction to provide a complete solution.

This article will detail the nature of a living trust, highlight its differences from a will, and explain why both are essential for protecting your assets and loved ones.

What a Will Means

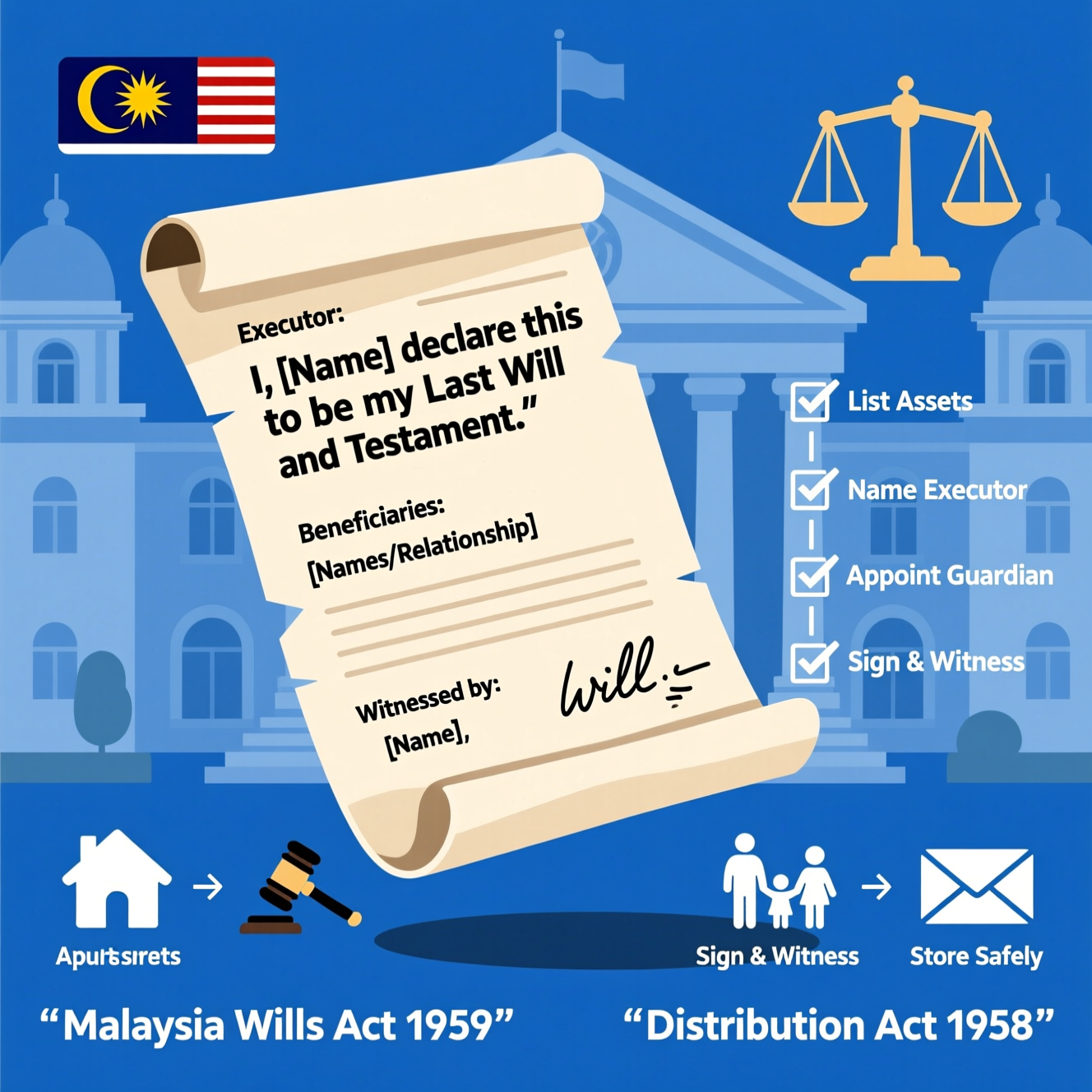

A will is a document that states how you want your assets handled after you die. Under Malaysia’s Wills Act 1959 for non-Muslims, you must sign the document and witness it according to law. You name your executor. You decide who gets what. You may also appoint a guardian for minor children.

A will is simpler and cheaper than many other tools in estate planning. For example, the cost of writing a will in Malaysia via a basic will writing service might start at around RM350-RM500 in many cases.

If you die without a valid will, your assets will be distributed under the Distribution Act 1958, and you lose control of how they are distributed.

You can write a will yourself or use a will writing service. If you choose to write a will without a lawyer in Malaysia, you must still ensure compliance with the formalities (signed, witnessed, clear instructions). For example, when writing a will you need to list your assets, name beneficiaries, choose an executor, and store the will safely.

What a Trust Means

A trust is a legal arrangement where you place assets into a structure managed by a trustee for your beneficiaries. The trustee holds and manages those assets under the terms you set. Trusts can take effect while you are alive or upon your death. This is a major difference with wills.

Trusts offer more control and can avoid probate, reduce delays, and provide privacy. For instance, in Malaysia, using a living trust helps avoid the public probate process. But setting up a trust costs more. According to one source in Malaysia, the cost of setting up a living trust ranges from about RM5,000 to RM20,000, depending on the complexity.

You’ll need legal and financial advice if using a trust. You’ll need to transfer assets into the trust properly. Without that, you lose the advantage.

Differences Between Will and Trust

Wills and trusts are quite different in these key ways:

- Effect timing: A will only take effect after your death. A trust may take effect during your life.

- Probate: Wills generally go through probate, which delays distribution. Trusts often avoid probate.

- Privacy: Wills become public records once validated. Trusts remain private.

- Control and complexity: Trusts give more detailed control (when and how assets are distributed). Wills are simpler.

- Cost: Wills cost less up front; trusts cost more but may save in administration later. Understanding these differences helps you answer “which tool suits me”.

When a Will Suffices for Estate Planning?

You should rely on a will when your situation meets certain conditions. For example:

- You have a moderate-sized estate: one property, savings, and no complicated business holdings.

- You want to appoint a guardian for minor children.

- You want to distribute your assets simply.

- You want to use a cost-effective tool.

In this case, you might look into writing a will through a will-writing service. The process is simpler, faster, and more budget-friendly. If you are comfortable writing a will yourself, you can follow how to write a will without a lawyer in Malaysia steps such as listing assets, naming beneficiaries, appointing an executor, signing with two witnesses, and storing the will safely. Using a will in this context gives you control and clarity.

When a Trust Becomes Valuable

Use a trust when your estate is more complex or you have special needs. For example:

- You own business interests, multiple properties, and foreign holdings.

- You have dependents with special needs or want to control long-term distribution.

- You want to avoid probate and maintain privacy.

In Malaysia, there are reports of increased demand for trusts from parents and business owners wanting better control. Setting up a trust lets you define how and when assets flow to beneficiaries, even if you become incapacitated.

If you go this route, you will need professional help, since a trust setup involves higher costs and formalities. Think about the cost of writing a will compared with the cost of establishing a trust. A will might cost a few hundred ringgit; a trust might cost thousands.

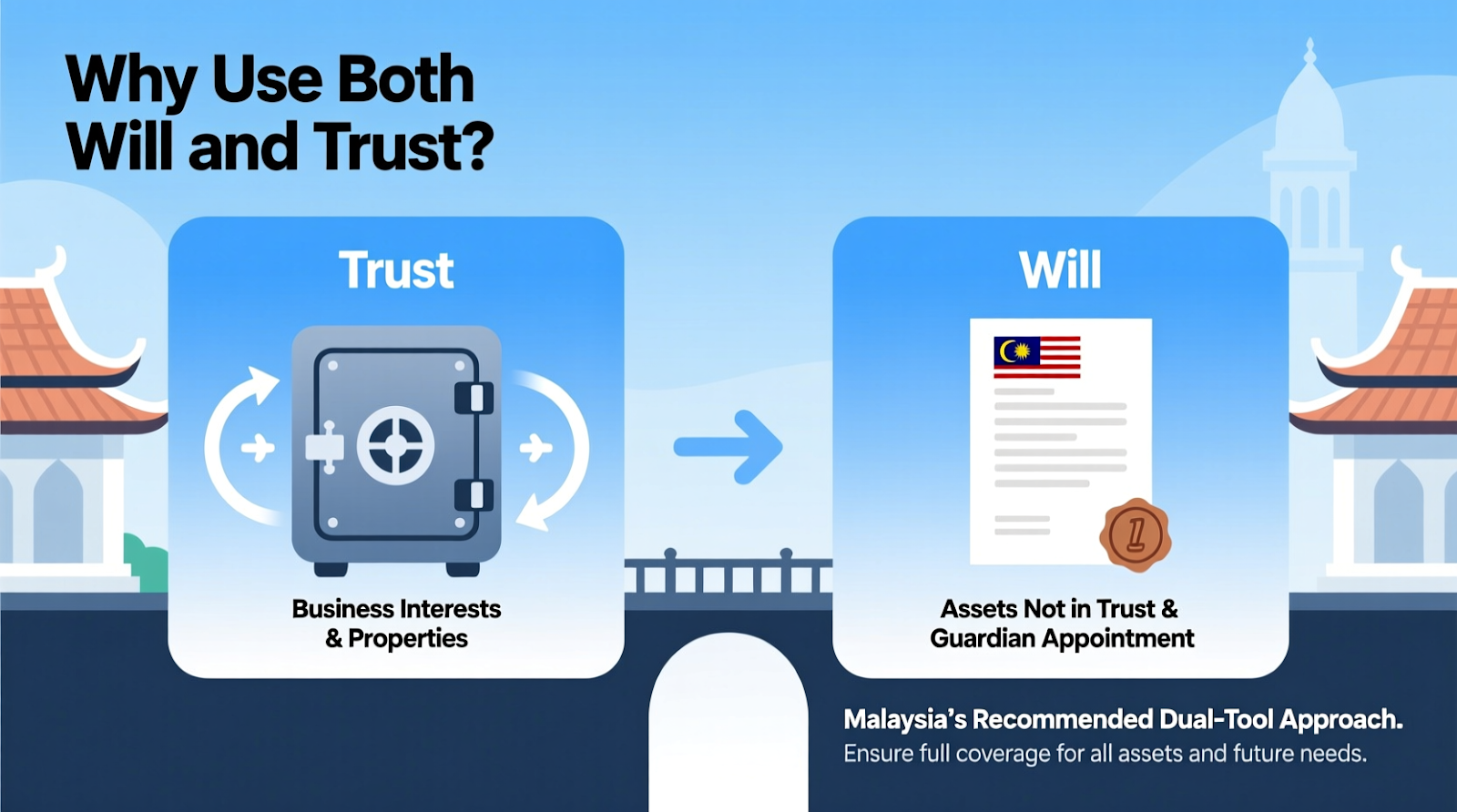

Why You Might Use Both Will and Trust?

Often, people use both a will and a trust to cover all bases. A trust covers the major assets and ongoing management; a will covers assets not placed into the trust and appoints guardians. In Malaysia, many experts recommend this dual-tool approach.

For example, if you set up a trust for your business interests and properties, you still maintain the ability to acquire new assets after trust setup, and to appoint guardians for children. This ensures you are covered in all scenarios.

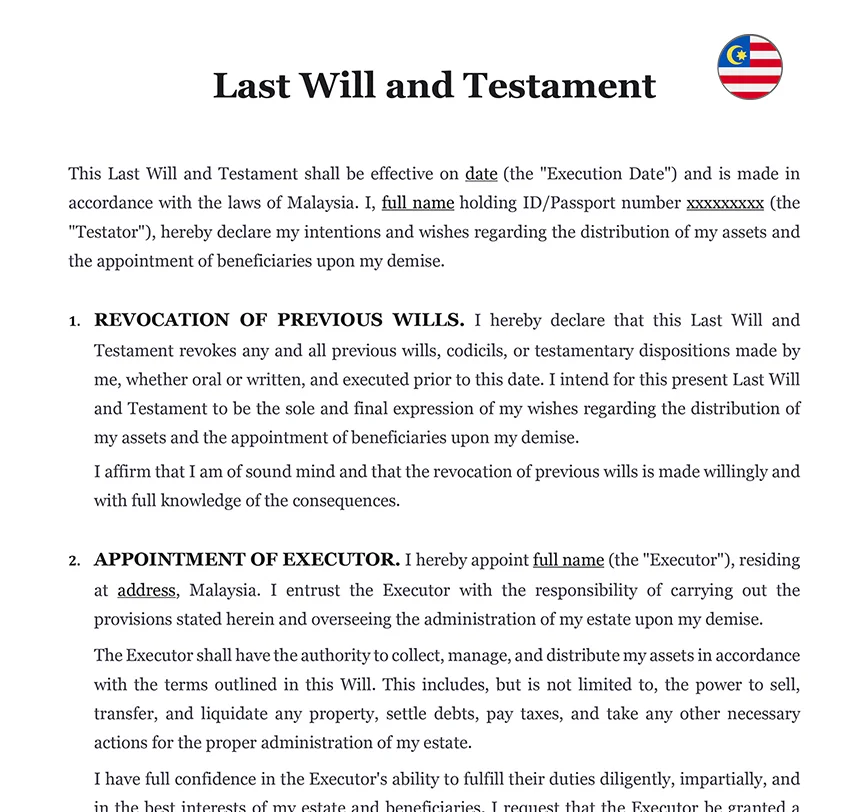

How to Write a Will in Malaysia

Image Credit: Testament to document final wishes

Here is a practical guide you can follow to write your will:

- Inventory all your assets: list real estate, business interests, savings, and overseas assets.

- Decide and name your beneficiaries and how you want your assets to be distributed.

- Name an executor who will apply for probate and manage your estate after death.

- If you have minor children, appoint a guardian.

- Draft the will document. You may use a will-writing service or draft it yourself. If using a service check cost, whether lawyers are involved and whether amendments are included.

- Sign the will with the required witnesses (in Malaysia, for non-Muslims, you need two witnesses).

- Store the will in a safe place and inform your executor where it is located.

If you choose the self-help route (how to write a will without a lawyer in Malaysia), ensure you understand the legal formalities and use a clear document. Errors may create delays or conflicts.

You should review your will whenever major life changes occur (marriage, divorce, addition of children, major asset purchase).

Cost of Writing a Will

Understanding cost helps you plan your budget. Typical cost in Malaysia:

- A basic will via an online or bank-based will writing service may cost between RM300 and RM1,000, depending on complexity. For example, some services list from RM350.

- A full lawyer-based will with more complex clauses may cost more, perhaps RM1,000 or more, depending on asset size and number of beneficiaries.

- The cost of a trust may range from RM5,000 to RM20,000 or more, depending on assets and complexity in Malaysia.

When you compare the tools, note that a slightly higher cost now may reduce administration delay and legal disputes later. The phrase “cost of writing a will” thus covers not only the drafting fee but also potential probate costs, delays, and the burden on your loved ones.

Final Thoughts: Will and a Trust in Malaysia

You control your estate planning. You decide whether a will, a trust, or both fit your situation. Use clear-cut tools. Use the right keywords: will vs trust Malaysia, will writing service, how to write a will without a lawyer in Malaysia, writing a will, cost of writing a will.

If your estate is straightforward, use a solid will. If you have complex assets or need enhanced control, use a trust (or both). Start the work now. Review your plan periodically. You’ll give your family clarity and reduce legal hassles.

Unlock Your Wealth Management with HWG Asia – Malaysia’s Leading Wealth Management Partner

You can always explore more at HWG!

HWG is a wealth management firm in Malaysia, offering wealth accumulation services tailored to Malaysian needs. From wealth advisory, estate and retirement planning to investment management (it is delivered by appropriately licensed entities), we provide expert advice and secure, personalized solutions that empower you to achieve wealth and financial security.

Whether you’re a young professional just starting to save and invest or a high-net-worth individual seeking advanced wealth strategies, HWG’s client-first model ensures that your goals are met with integrity and expertise.

Discover How HWG Can Help You Manage Your Wealth:

- Estate & Retirement planning solutions for every life stage.

- Investment management strategies are designed to maximize returns while managing risk (it is delivered by appropriately licensed entities).

- Ongoing support with regular reviews to ensure your plan evolves with you.

Contact HWG Malaysia Today:

Address: 29, Jalan SS 21/37, Damansara Utama, 47400 Petaling Jaya, Selangor

Email: customerservice@hwg.asia

Phone: 03-7732 6189

Inquiry: Contact Us

Visit HWG Malaysia’s Social Media Profiles:

Website: https://www.hwg.asia/

Facebook: https://www.facebook.com/hwg.asia

LinkedIn: https://www.linkedin.com/company/hwgasia/

Download the HWG Apps (available on the Play Store and App Store)!

HWG Hub: HWG Hub (For Internal Partner Use Only)

HWG Go: Coming soon

Disclaimer:

This article, published on this website, may be written or contributed by subject-matter experts or external writers. They are intended for general information and educational purposes only. HWG does not guarantee the accuracy, completeness, or timeliness of the information provided. Please note that the products, services or solutions in these articles may not be offered or provided by HWG. HWG shall not be held responsible or liable for any loss, damage,or issues arising from the use of, or reliance on such information.