Private Trust Company Malaysia: The HNWI’s Guide to Asset Protection and Legacy Planning

As wealth grows in complexity, high-net-worth individuals (HNWIs) in Malaysia are increasingly seeking structures that offer privacy, control, and long-term protection. For those who aim to preserve their legacy and control how their assets are managed and passed down, establishing a Private Trust Company (PTC) in Malaysia has become a powerful solution. More than just a tool for asset holding, a PTC provides a strategic framework that enables families to manage multiple trust funds, exercise governance, and navigate succession with clarity and efficiency.

This guide explores how a PTC works, how it differs from traditional trustee companies in Malaysia, and why it is fast becoming the preferred choice for families and business owners safeguarding intergenerational wealth.

What Is a Private Trust Company (PTC)?

A Private Trust Company in Malaysia is a specially incorporated company created to serve as a trustee for one or more family trusts. Unlike public trust companies that serve multiple unrelated clients, a PTC is typically owned and controlled by a single family. Its primary role is to act as the trustee for the family’s trust funds, giving them full control over asset management, governance decisions, and succession planning.

The key advantage of a PTC lies in its flexibility. The family can appoint its board of directors, include trusted advisors, and maintain decision-making authority over the trust company without depending on external trustees who may not fully understand the family’s vision or values.

Why High-Net-Worth Individuals (HNWI’s) Prefer a PTC in Malaysia?

For affluent families, wealth management extends far beyond investment performance. The ability to protect, control, and seamlessly transfer wealth across generations is vital. A private trust company in Malaysia enables this by offering structured oversight over assets, trusts, and succession processes.

Main reasons HNWIs opt for a PTC include:

- Privacy and Confidentiality: Ownership and internal decisions stay within the family circle, avoiding exposure associated with public trustees.

- Control Over Trustee Duties: Unlike third-party trustee companies in Malaysia, a PTC allows families to retain authority over trustee roles, investment decisions, and beneficiary management.

- Asset Protection: Trust structures within a PTC shield family wealth from legal disputes, creditor claims, and probate proceedings.

- Continuity: The company structure ensures that family governance continues even after the passing of the founder or settlor.

PTC vs Traditional Trust Company: What’s the Difference?

While both PTCs and professional trust companies serve as trustees, their structure and purpose vary significantly. A trustee company in Malaysia typically provides professional fiduciary services to many clients. These institutions are regulated and operate independently from the families whose trusts they manage.

In contrast, a PTC is a bespoke entity managed by or on behalf of one family. It does not offer trustee services to the public and is exempt from certain licensing requirements when it serves only internal family trusts.

| Feature | Private Trust Company (PTC) | Traditional Trust Company |

| Control | Family-appointed directors | External professionals |

| Scope | One family only | Multiple public clients |

| Privacy | High | Moderate |

| Customisation | Fully tailored | Standardized services |

| Licensing Requirement | Exempt (for family-only use) | Requires trust license |

This distinction makes PTCs ideal for wealthy families who want long-term control over their legacy without relinquishing authority to outside fiduciaries.

Asset Protection Through Private Trust Structures

One of the most compelling reasons to set up a PTC is to enhance asset protection. When assets are transferred into a trust fund managed by a PTC, they are no longer personally owned by the settlor or individual family members. This separation provides legal insulation, which protects wealth from risks such as divorce settlements, creditor claims, lawsuits, or bankruptcy.

This protection is especially valuable in Malaysia’s evolving economic environment, where HNWIs may be involved in business ventures or cross-border investments that increase legal exposure. The PTC ensures that assets—whether cash, shares, or property—are securely managed under the trust company and protected for future generations.

Labuan: The Preferred Jurisdiction for PTC Formation

The Edge Malaysia. (2016, October 17–23). The taxman is taking a closer look at Malaysian corporates in Labuan. The Edge Malaysia Weekly. (https://theedgemalaysia.com/article/taxman-taking-closer-look-malaysian-corporates-labuan-businesses)

While a PTC can be set up in Malaysia under domestic law, many HNWIs choose Labuan as the preferred jurisdiction. Labuan is a Federal Territory of Malaysia known for its Labuan business-friendly tax system, confidentiality provisions, and global financial recognition.

Benefits of setting up a PTC in Labuan include:

- Tax Efficiency: 3% corporate tax or RM20,000 flat annual tax under Labuan IBFC guidelines

- International Trust Law Framework: Globally accepted standards that provide clarity and compliance

- Simple Incorporation Process: Fewer regulatory hurdles compared to other offshore jurisdictions

- Currency and Ownership Flexibility: PTCs can manage foreign assets, currencies, and international investments without restriction

Labuan is also widely used for creating cash trusts, asset holding companies, and investment platforms that align with estate and tax planning strategies for both Malaysian and foreign families.

Private Trust Companies and Cash Trust Integration

Many families utilize cash trusts as part of their overall wealth structure. A cash trust is a type of trust that holds liquid assets such as savings, insurance payouts, or investment proceeds. When integrated with a PTC, a cash trust can be administered with greater oversight and flexibility.

The PTC oversees the distribution terms, investment rules, and reporting for each trust fund, ensuring that liquidity is used according to family governance frameworks. This approach is especially useful for:

- Education funds

- Medical expense provisions

- Emergency family liquidity planning

- Philanthropic giving or foundations

Because the PTC operates as a central management entity, it creates a seamless experience across multiple trusts and family purposes.

Who Should Consider a Private Trust Company in Malaysia?

A Private Trust Company in Malaysia is best suited for:

- Families with substantial or diversified assets (local and offshore)

- Business owners planning for corporate succession and estate continuity

- Families with multiple trust funds or beneficiaries across generations

- HNWIs seeking full control and confidentiality in their estate structure

- Clients with complex inheritance wishes or cross-border tax considerations

If privacy, asset protection, and long-term governance are important to you, a PTC structure can offer solutions that standard trustee relationships cannot.

How to Establish a PTC in Malaysia

While setting up a PTC requires professional guidance, the steps are relatively straightforward:

- Determine objectives: Define the number of trusts, types of assets, and governance approach

- Choose jurisdiction: Decide between Labuan or onshore Malaysia, based on tax and asset needs

- Incorporate the company: Register the entity under the relevant Companies Act (Labuan or domestic)

- Appoint directors and compliance officers: Include trusted family members or advisors

- Draft trust deeds: Structure the trust funds according to legal, tax, and family considerations

- Ensure ongoing compliance: Maintain company records, filings, and governance reports

Conclusion: Securing Wealth Through a Private Trust Company

Establishing a Private Trust Company in Malaysia empowers high-net-worth families to take full control of their wealth management and succession planning. It blends the strengths of legal structure, governance, and asset protection into one cohesive platform. Whether you’re seeking to shield assets through trust funds, manage intergenerational transfers, or retain confidentiality, a PTC offers unmatched flexibility and authority.

As Malaysia’s financial ecosystem continues to evolve, HNWIs need solutions that provide more than just financial returns—they need assurance, continuity, and control. A Private Trust Company does exactly that.

Unlock Your Wealth Management with HWG Asia – Malaysia’s Leading Wealth Management Partner

You can always explore more at HWG!

HWG is a premier wealth management firm in Malaysia, offering wealth accumulation services tailored to Malaysian needs. From estate and retirement planning to investment management, we provide expert advice and secure, personalized solutions that empower you to achieve wealth and financial security.

Whether you’re a young professional just starting to save and invest or a high-net-worth individual seeking advanced wealth strategies, HWG’s client-first model ensures that your goals are met with integrity and expertise.

Discover How HWG Can Help You Secure Your Wealth:

- Estate & Retirement planning solutions for every life stage.

- Investment management strategies are designed to maximize returns while managing risk.

- Ongoing support with regular reviews to ensure your plan evolves with you.

Upcoming Seminar By HWG

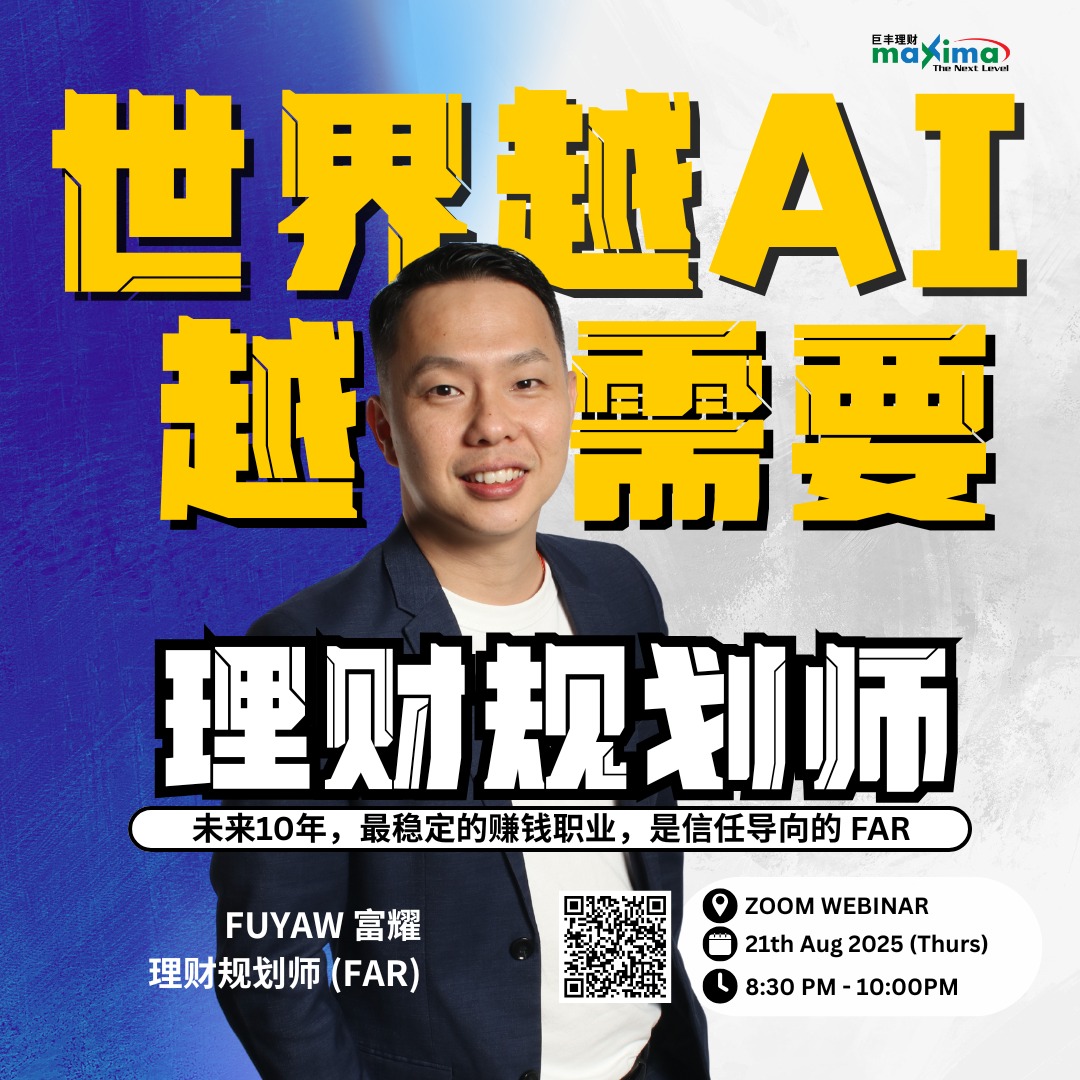

Join Fuyaw (FAR) for a practical Zoom session on why trust-centered advisors will thrive over the next decade—and how to position yourself now.

When: 21 Aug 2025 (Thu), 8:30–10:00 PM

Where: Zoom Webinar

You’ll learn:

The FAR career path: skills, tools, and income potential

Scan the QR on the poster for the registration link.

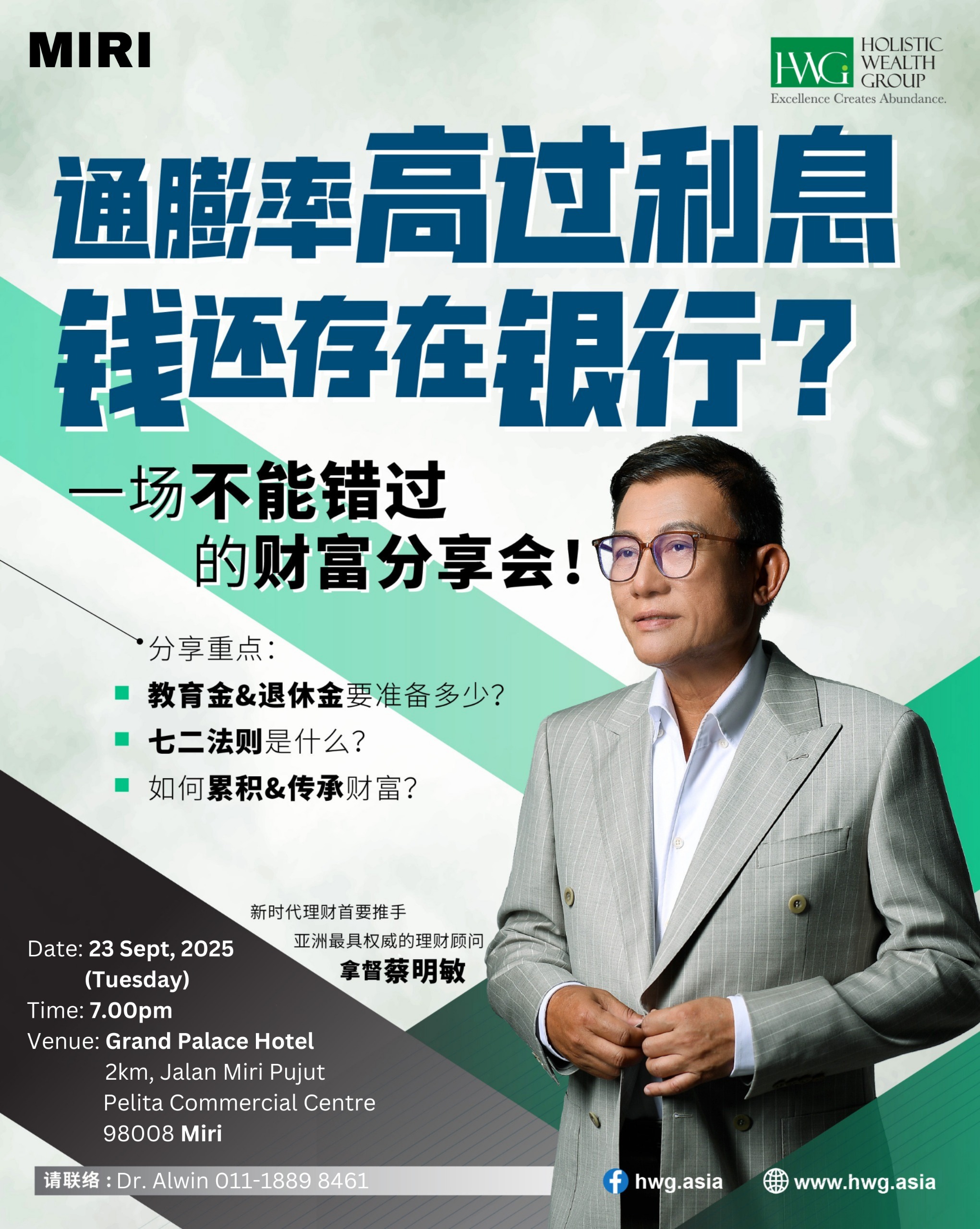

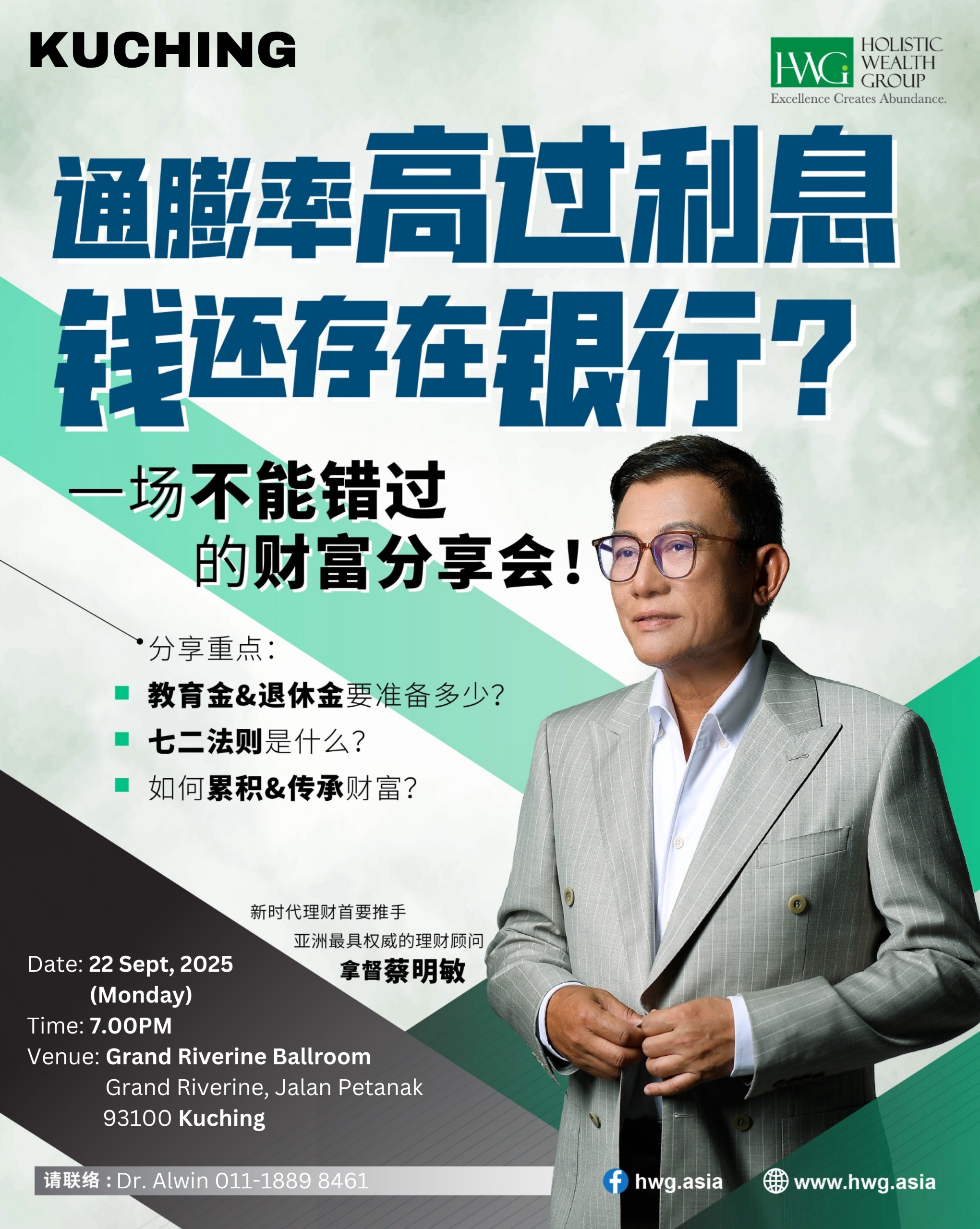

Inflation Higher than Interest Rates – Should You Still Save in the Bank?

Holistic Wealth Group invites you to an exclusive wealth sharing session with Asia’s most respected Wealth Advisor, Dato’ Eagle Chua.

Learn how to protect and grow your wealth in uncertain times.

Key topics:

- How much should you prepare for education and retirement funds

- What is the Rule of Seven

- How to accumulate and pass on wealth effectively

Kuching Session

- Date: 22 September 2025 (Monday)

- Time: 7.00 PM

- Venue: Grand Riverine Ballroom, Grand Riverine, Jalan Petanak, 93100 Kuching

Miri Session

- Date: 23 September 2025 (Tuesday)

- Time: 7.00 PM

- Venue: Grand Palace Hotel, 2km, Jalan Miri Pujut, Pelita Commercial Centre, 98008 Miri

Don’t miss this important event. Gain practical strategies to secure your financial future.

For enquiries, please contact Dr. Alwin at 011-1889 8461 or WhatsApp 019-6399834.

中文版本

通胀率高过利息,钱还存在银行?

Holistic Wealth Group 诚邀您参加一场不能错过的财富分享会,由亚洲最具权威的理财顾问 拿督蔡明敏亲自主讲。

学习如何在不确定的环境中保护和增长您的财富。

重点分享内容:

- 教育金和退休金要准备多少

- 七二法则是什么

- 如何累积和传承财富

古晋场

- 日期:2025年9月22日(星期一)

- 时间:晚上7点

- 地点:Grand Riverine Ballroom, Grand Riverine, Jalan Petanak, 93100 Kuching

美里场

- 日期:2025年9月23日(星期二)

- 时间:晚上7点

- 地点:Grand Palace Hotel, 2km, Jalan Miri Pujut, Pelita Commercial Centre, 98008 Miri

把握这次机会,获取实用的理财策略,保障您的未来。

查询请联络 Dr. Alwin, 电话:011-1889 8461 或 WhatsApp 019-6399834。

Follow HWG for Exclusive Insights:

- Access expert advice and resources for making informed decisions.

- Stay updated on HWG’s services, events, and promotions tailored for you.

Contact HWG Malaysia Today:

Address: 29, Jalan SS 21/37, Damansara Utama, 47400 Petaling Jaya, Selangor

Email: customerservice@hwg.asia

Phone: 03-7732 6189

Inquiry: Contact Us

Visit HWG Malaysia’s Social Media Profiles:

Website: https://www.hwg.asia/

Facebook: https://www.facebook.com/hwg.asia

LinkedIn: https://www.linkedin.com/company/hwgasia/

Download the HWG Apps (Available on the Play Store and App Store)!

HWG Hub: HWG Hub (For Internal Partner Use Only)

HWG Go: Coming soon

Disclaimer:

This article published on this website may be written or contributed by subject-matter experts or external writers. They are intended for general information and educational purposes only. HWG does not guarantee the accuracy, completeness or timeliness of the information provided. Please note that the products, services or solutions in these articles may not be offered or provided by HWG. HWG shall not be held responsible or liable for any loss, damage or issues arising from the use of, or reliance on such information.