Retirement Planning Malaysia: How Much Money Do You Need to Retire Comfortably in Malaysia?

As Malaysia’s population continues to age, the importance of retirement planning Malaysia has never been more urgent. With longer life expectancies and the increasing cost of living, planning for retirement today ensures financial security tomorrow. Yet, many Malaysians are unsure how much money to retire in Malaysia or how to manage their retirement savings to sustain a comfortable lifestyle in their later years. This article provides insights into the key factors to consider when planning for retirement and how much you need to retire in Malaysia.

Understanding Retirement Planning Malaysia

Image Credit: https://www.successcreation.com.my

What is Retirement Planning Malaysia?

Retirement planning is the process of assessing your financial needs after you stop working and determining how much money you will need to sustain your lifestyle in your later years. It involves estimating future expenses, considering available income sources, and establishing an action plan for saving and investing.

Components of retirement planning Malaysia include:

- Estimating expected expenses (housing, rising healthcare costs, daily living expenses, and retirement lifestyle).

- Making investment decisions that can provide income during retirement.

- Planning for tax implications and long-term income security.

Why Is Retirement Planning Important?

With Malaysia’s elderly population set to reach 2.9 million by 2026, the need for sound retirement planning in Malaysia has become critical. If you don’t start planning early, you risk:

- Financial Instability: Without proper savings, you might face financial dependence on others or the government.

- Lifestyle Sacrifices: Inflation and rising living costs may make it harder to maintain your pre-retirement lifestyle.

- Healthcare Expenses: As you age, healthcare costs become a major concern, and without proper planning, it could strain your savings.

Things to Consider When Planning for Retirement

Lifestyle and Spending Needs

Your retirement needs largely depend on your lifestyle. Factors such as housing, transportation, food, and healthcare must be estimated accurately to avoid underfunding. Lifestyle preferences, like extensive travel or pursuing hobbies, will significantly affect the amount you need.

Inflation Rate in Malaysia

Image credit: Consumer Prices – OpenDOSM

One of the most overlooked factors in retirement planning in Malaysia is inflation. Even a modest 2-3% inflation rate can substantially erode the value of your savings over time. For instance, if you need RM5,000 per month now, you might need RM7,430 per month in 20 years, just to maintain the same lifestyle. As for July 2025, the inflation rate in Malaysia is 1.2% as per Consumer Prices by OpenDOSM.

Retirement Age in Malaysia

Minimum Retirement Age Act 2012 Downloadable PDF

The Minimum Retirement Age Act 2012, which took effect on 1 July 2013, mandates a retirement age of 60 for employees in Malaysia. This law prevents employers from forcing staff into retirement before they turn 60, ensuring job security for workers up to that age. However, the latest update of the review of raising the retirement age to 65. The Ministry of Human Resources is currently reviewing a proposal to increase the mandatory retirement age to 65, according to Malay Mail.

Deciding when to retire is crucial because the earlier you retire, the longer your savings must last. If you plan to retire at 55, your savings will need to support you for a longer period compared to retiring at 65.

Current Savings and Investments

Your existing savings, including EPF contributions, and any other investments (stocks, bonds, property) play a critical role in determining how much more you need to save. The Employees Provident Fund (EPF) provides a foundation for retirement planning, but it may not be sufficient on its own for a comfortable lifestyle.

Rising Healthcare Cost Considerations

Retrieved from: Current health expenditure (% of GDP) – Malaysia | Data by World Bank Group

As you age, healthcare costs tend to increase. It’s vital to include provisions for medical insurance in your retirement planning. Unexpected medical expenses can quickly deplete savings, so having a solid plan for healthcare costs is essential. Getting the medical card and life insurance at a young age very crucial move for retirement planning, as these products act as income protection to save your financial burden during a hard time.

How Much Money Do You Really Need to Retire Comfortably in Malaysia?

EPF’s Retirement Income Adequacy (RIA) Framework

Credit Sources: EPF Releases Belanjawanku 2024/2025 And Retirement Income Adequacy Framework

The Employees Provident Fund (EPF) recently introduced the Retirement Income Adequacy (RIA) Framework, which provides a guideline on how much you need to save for a comfortable retirement. The framework is based on three tiers:

- Basic Savings: RM390,000 – for essential retirement needs.

- Adequate Savings: RM650,000 – for a reasonable standard of living.

- Enhanced Savings: RM1.3 million – for a higher quality of life and more financial independence.

According to the EPF, a single elderly person will need approximately RM2,690 per month to maintain a reasonable standard of living in retirement, adjusted based on their desired lifestyle and location.

The Rule of Thumb

A common rule of thumb is that retirees need about 70-80% of their pre-retirement income to maintain their standard of living. However, this general guideline doesn’t apply to everyone. Some may want to travel, start a new business, or have additional healthcare needs, which could require more savings.

How to Calculate Your Retirement Number

To calculate how much you need:

- Estimate your monthly retirement expenses: Consider housing, food, transportation, and healthcare.

- Account for other income sources: Include your EPF, rental income, dividends, and pensions. These can supplement your savings.

- Calculate your total retirement fund: Multiply your annual expenses by 25, using the “4% rule.” This rule suggests you can safely withdraw 4% of your portfolio annually over 30 years, factoring in inflation.

- Adjust for inflation: An average inflation rate of 2% per year will significantly impact your retirement needs, so adjust your target accordingly.

For example, if you anticipate needing RM5,000 per month today, after 20 years, that amount could increase to RM7,430 per month due to inflation.

Investment Strategies to Ensure a Comfortable Retirement

Investment Options for Retirement Savings

To meet your retirement goals, it’s important to explore various investment options:

- EPF: Malaysia’s mandatory retirement savings program.

- Private Retirement Schemes (PRS): Voluntary contributions to supplementary retirement funds.

- Unit Trusts: Managed funds that pool money from investors for diversified investment.

- Stocks, Bonds, and Real Estate: Long-term investments that can offer higher returns.

Importance of Diversification

Diversification is essential to reduce risk. A well-balanced portfolio should mix higher-risk, higher-return assets like stocks with lower-risk, stable income sources like bonds.

Leveraging Compound Interest

The earlier you start saving, the more you benefit from compound interest. The key is to invest early and consistently. For instance, a RM10,000 investment earning 5% annually will grow to RM10,500 in the first year, with the next year’s interest calculated on the total amount.

Regularly Reviewing and Adjusting Your Plan

It’s essential to review your retirement planning regularly. As your life circumstances change (new job, marriage, children, etc.), so should your plan. Regular reviews ensure that you stay on track to meet your goals.

Mistakes to Avoid When Planning for Retirement

- Underestimating Retirement Expenses

Many people underestimate their retirement costs, particularly healthcare and lifestyle changes. Always overestimate rather than underestimate your needs.

- Failing to Diversify Investments

All investments carry risks. Avoid putting all your eggs in one basket. Diversifying your retirement savings across different asset classes ensures you’re protected from major losses.

- Not Starting Early Enough

The earlier you start saving for retirement, the better. Compound interest works best when given time to grow.

- Ignoring Estate Planning

Estate planning ensures your assets are distributed according to your wishes. Without it, your family may face unnecessary challenges during an already difficult time.

How EPF and Other Government Programs Help

The EPF is a vital tool in your retirement planning in Malaysia. It provides a foundation for your savings, but on its own, it may not be enough to live comfortably. Other government programs, like Belanjawanku, help individuals estimate their living costs and adjust savings targets to meet their needs.

The RIA Framework is an essential resource for gauging whether your EPF savings will be enough. EPF also offers other tools like i-Invest, which allows you to manage and invest your EPF savings in approved funds to grow your retirement savings.

Conclusion: Plan Now Your Retirement Planning in Malaysia to Live Comfortably in the Golden Age

Retirement planning in Malaysia is essential for ensuring that your later years are financially secure and comfortable. While the amount needed varies depending on lifestyle, expenses, and inflation, the earlier you start, the better. Using tools like the EPF’s RIA Framework, diversifying your investments, and factoring in inflation will help you stay on track to meet your retirement goals.

Remember, retirement planning isn’t about chasing a fixed number; it’s about ensuring your savings can sustain your desired lifestyle. By starting early, reviewing your plan regularly, and seeking professional advice, you’ll increase your chances of achieving a fulfilling retirement.

Unlock Your Wealth Management with HWG Asia – Malaysia’s Leading Wealth Management Partner

You can always explore more at HWG!

HWG is a premier wealth management firm in Malaysia, offering wealth accumulation services tailored to Malaysian needs. From estate and retirement planning to investment management, we provide expert advice and secure, personalized solutions that empower you to achieve wealth and financial security.

Whether you’re a young professional just starting to save and invest or a high-net-worth individual seeking advanced wealth strategies, HWG’s client-first model ensures that your goals are met with integrity and expertise.

Discover How HWG Can Help You Manage Your Wealth:

- Estate & Retirement planning solutions for every life stage.

- Investment management strategies are designed to maximize returns while managing risk.

- Ongoing support with regular reviews to ensure your plan evolves with you.

Upcoming Seminar By HWG

Join Fuyaw (FAR) for a practical Zoom session on why trust-centered advisors will thrive over the next decade—and how to position yourself now.

When: 21 Aug 2025 (Thu), 8:30–10:00 PM

Where: Zoom Webinar

You’ll learn:

The FAR career path: skills, tools, and income potential

Scan the QR on the poster for the registration link.

Follow HWG for Exclusive Insights:

- Access expert advice and resources for making informed decisions.

- Stay updated on HWG’s services, events, and promotions tailored for you.

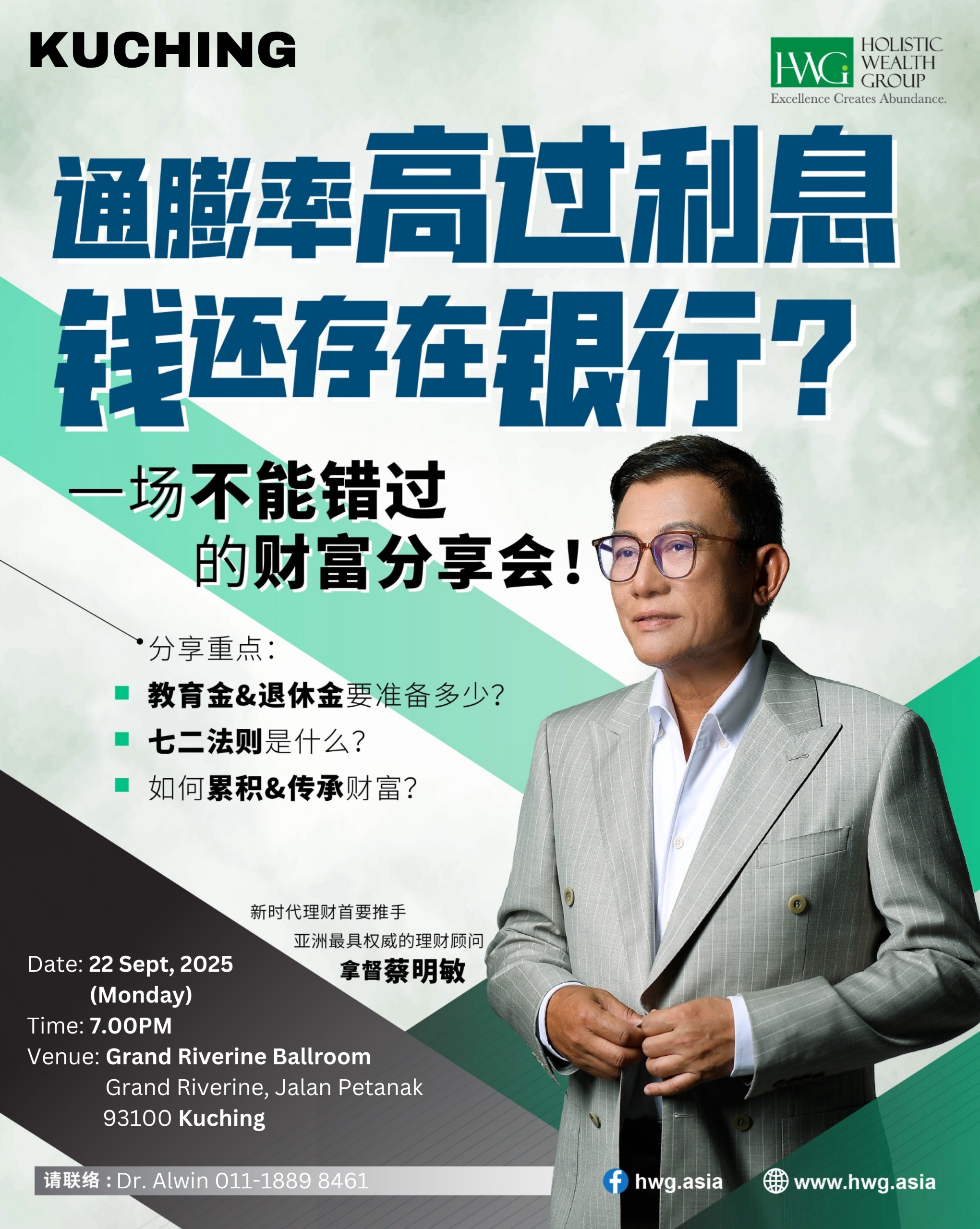

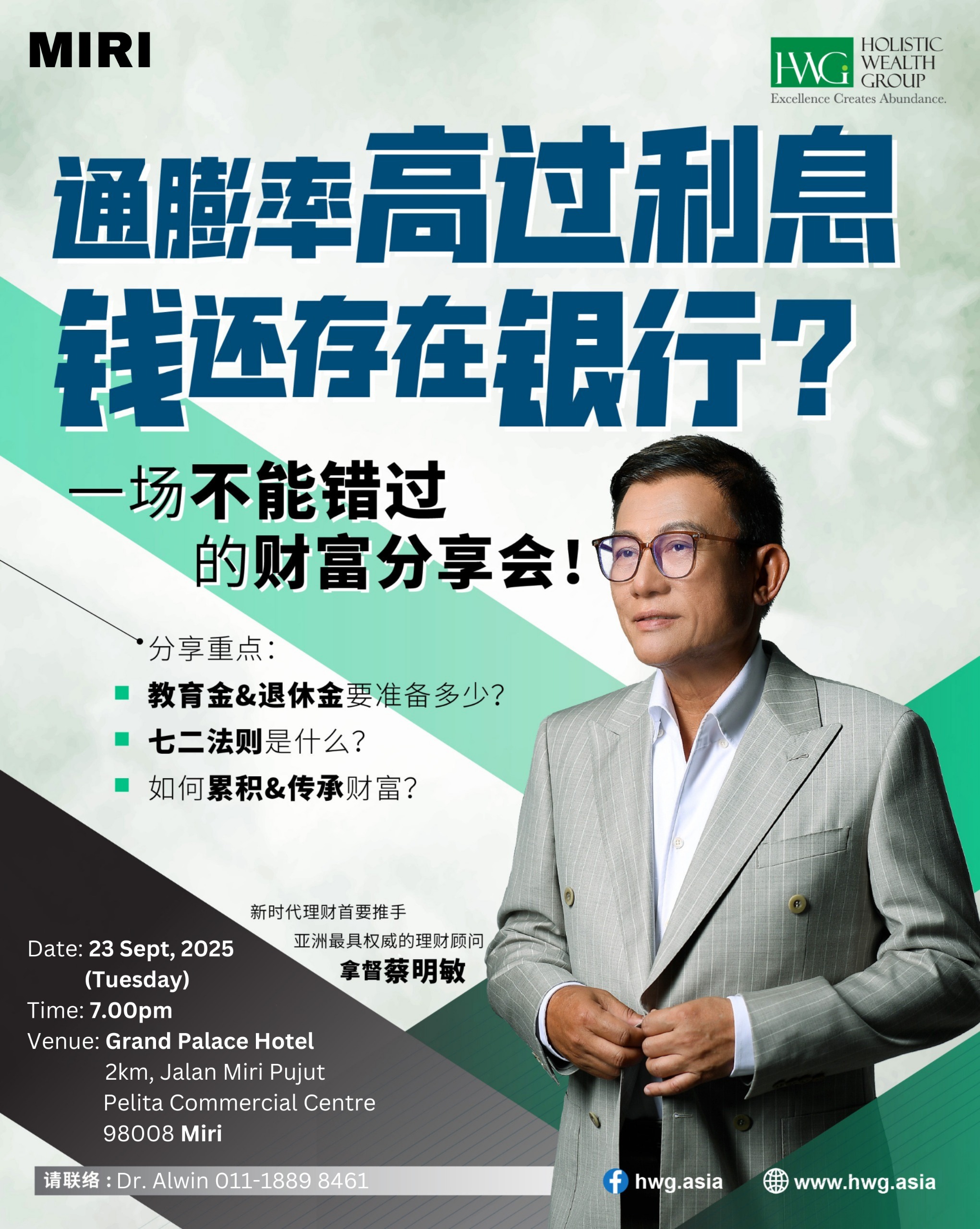

Inflation Higher than Interest Rates – Should You Still Save in the Bank?

Holistic Wealth Group invites you to an exclusive wealth sharing session with Asia’s most respected Wealth Advisor, Dato’ Eagle Chua.

Learn how to protect and grow your wealth in uncertain times.

Key topics:

- How much should you prepare for education and retirement funds

- What is the Rule of Seven

- How to accumulate and pass on wealth effectively

Kuching Session

- Date: 22 September 2025 (Monday)

- Time: 7.00 PM

- Venue: Grand Riverine Ballroom, Grand Riverine, Jalan Petanak, 93100 Kuching

Miri Session

- Date: 23 September 2025 (Tuesday)

- Time: 7.00 PM

- Venue: Grand Palace Hotel, 2km, Jalan Miri Pujut, Pelita Commercial Centre, 98008 Miri

Don’t miss this important event. Gain practical strategies to secure your wealth.

For enquiries, please contact Dr. Alwin at 011-1889 8461 or WhatsApp 019-6399834.

中文版本

通胀率高过利息,钱还存在银行?

Holistic Wealth Group 诚邀您参加一场不能错过的财富分享会,由亚洲最具权威的理财顾问 拿督蔡明敏亲自主讲。

学习如何在不确定的环境中保护和增长您的财富。

重点分享内容:

- 教育金和退休金要准备多少

- 七二法则是什么

- 如何累积和传承财富

古晋场

- 日期:2025年9月22日(星期一)

- 时间:晚上7点

- 地点:Grand Riverine Ballroom, Grand Riverine, Jalan Petanak, 93100 Kuching

美里场

- 日期:2025年9月23日(星期二)

- 时间:晚上7点

- 地点:Grand Palace Hotel, 2km, Jalan Miri Pujut, Pelita Commercial Centre, 98008 Miri

把握这次机会,获取实用的理财策略,保障您的未来。

查询请联络 Dr. Alwin, 电话:011-1889 8461 或 WhatsApp 019-6399834。

Contact HWG Malaysia Today:

Address: 29, Jalan SS 21/37, Damansara Utama, 47400 Petaling Jaya, Selangor

Email: customerservice@hwg.asia

Phone: 03-7732 6189

Inquiry: Contact Us

Visit HWG Malaysia’s Social Media Profiles:

Website: https://www.hwg.asia/

Facebook: https://www.facebook.com/hwg.asia

LinkedIn: https://www.linkedin.com/company/hwgasia/

Download the HWG Apps (Available on the Play Store and App Store)!

HWG Hub: HWG Hub (For Internal Partner Use Only)

HWG Go: Coming soon

Disclaimer:

This article, published on this website, may be written or contributed by subject-matter experts or external writers. They are intended for general information and educational purposes only. HWG does not guarantee the accuracy, completeness, or timeliness of the information provided. Please note that the products, services or solutions in these articles may not be offered or provided by HWG. HWG shall not be held responsible or liable for any loss, damage, or issues arising from the use of, or reliance on such information.