Digital Wealth Management Malaysia Guide: The Fintech Wealth Malaysia Trends in 2025/2026

Malaysia’s investing experience has moved from counters and paper forms to secure, phone-first investment apps. Remote e-KYC lets you open accounts in minutes, DuitNow moves money in real time, licensed robo-advisors under the Securities Commission’s Digital Investment Management (DIM) framework keep portfolios on track, and EPF i-Invest brings selected retirement funds online. Put together, digital wealth management in Malaysia now means lower friction, clearer fees, and more goal-based investing.

Frictionless Onboarding and Instant Funding (e-KYC + DuitNow)

Opening an account used to be slow. With modern e-KYC, you verify your identity via MyKad/Passport capture and a short liveness check—no branch visit, no paper pack. Funding is just as smooth: DuitNow transfers and QR enable near-instant deposits and withdrawals across banks and e-wallets, which helps dollar-cost-averaging stay on schedule and reduces idle cash.

Regulated Robo Advice And Retirement Flows (Digital Investment Management + EPF i-Invest)

Once the account is live, the question is “What should I hold?” Licensed robo-advisors—operating under Malaysia’s DIM rules—translate your goals and risk tolerance into diversified portfolios, then rebalance automatically to keep allocations aligned. Fees and methodology are disclosed in-app, and Shariah-aligned options are easier to select.

For long-term savings, EPF i-Invest brings approved unit-trust exposure into the familiar EPF portal so you can review fund info, compare costs and track records, and place transactions online.

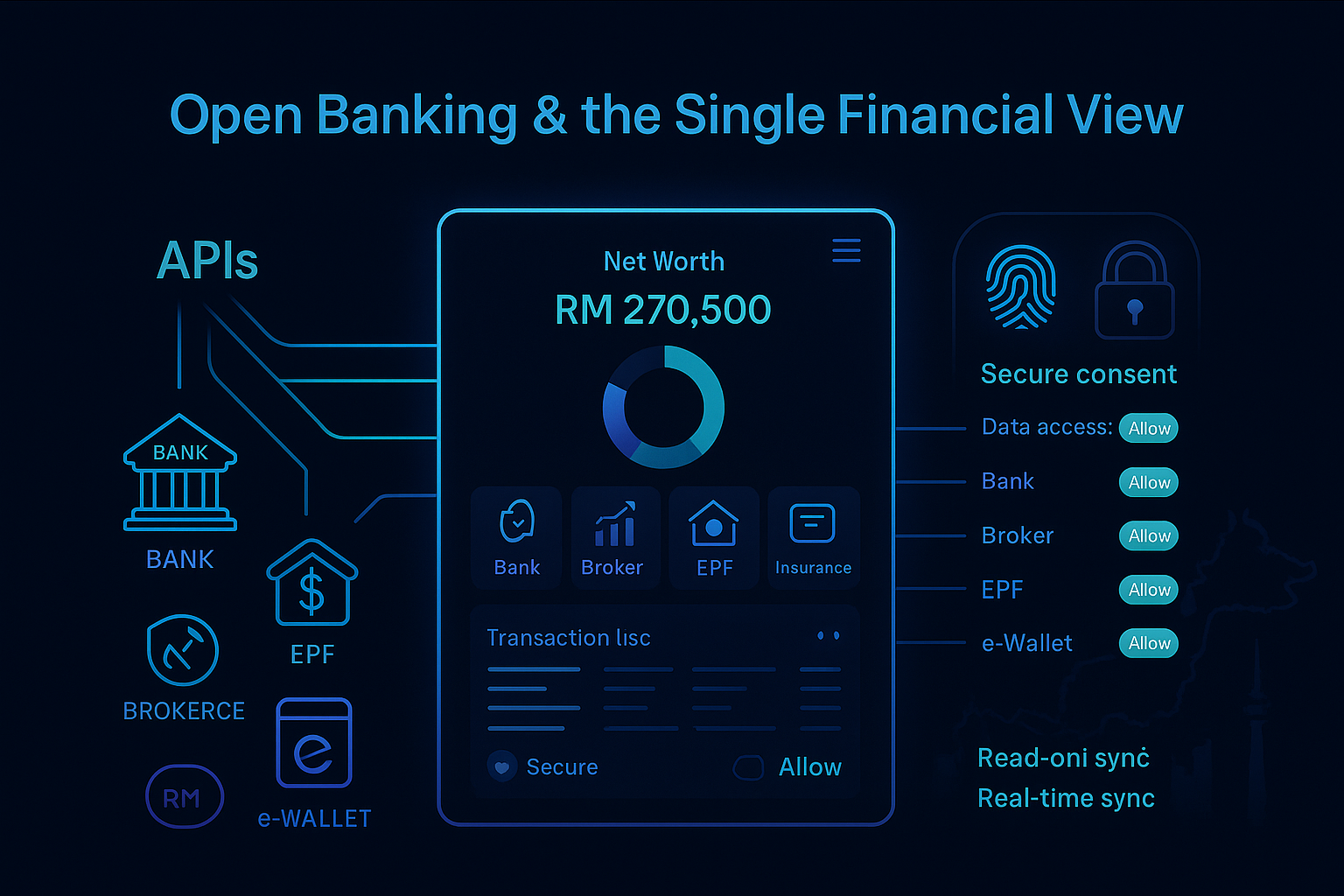

Open Banking and The Single Financial View

As open banking matures, consent-based data sharing helps your bank, broker, protection, and tax tools talk to each other. The payoff is a true wealth dashboard inside your preferred investment app: one screen for cash, EPF, unit trusts, robo portfolios, liabilities, and upcoming bills—plus nudges when you drift off target.

Why this shift matters

- Less friction: e-KYC helps you start sooner; DuitNow keeps contributions and withdrawals timely.

- More transparency: DIM platforms disclose process and fees.

- Better discipline: Automated rebalancing supports goal-based plans.

Before you commit: a quick checklist

- Verify the platform is licensed (e.g., appears on the SC register) and avoid names on the Investor Alert List.

- Add up total costs (platform/management + fund TER + FX/transaction + spreads).

- Read how rebalancing works and confirm security (MFA, device binding) and support hours.

- If you want Shariah exposure, check the screening methodology and benchmarks.

Three investor journeys (examples)

- First-time saver: Opens with e-KYC, sets a monthly DuitNow transfer, and uses a conservative, goal-based robo portfolio.

- EPF optimiser: Allocates a portion of Account 1 via EPF i-Invest into low-cost funds and tracks them alongside external holdings.

- Busy professional: Aggregates bank, brokerage, and protection via open banking; gets alerts to rebalance and sweeps surplus cash into the portfolio automatically.

Conclusion: Digital Wealth Management In Malaysia Is Changing With the Fintech Company

Conclusion: Driven by e-KYC, DuitNow, and licensed Digital Investment Management (DIM) platforms, digital wealth management in Malaysia is becoming faster, clearer, and more goal-based. Fintech companies are improving access and transparency while keeping processes within a regulated framework. Before you commit, verify licensing, compare all-in fees, and confirm security features. For guidance tailored to your needs, speak with a licensed adviser.

FAQs

1) Is digital wealth management in Malaysia safe, and how do I verify a platform?

Look for a licence from the Securities Commission Malaysia (often under Digital Investment Management for robo-advisors). Check the SC register, avoid names on the Investor Alert List, and prefer investment apps with MFA, device binding, and clear data policies.

2) What costs should I expect—and how do I compare them?

Consider the all-in annual cost: platform/management fee + fund TER + FX/transaction fees + spreads. Lower costs help compounding.

3) Robo-advisor vs DIY/unit trust—what’s the difference?

A licensed robo-advisor automates selection, rebalancing, and fee visibility under a regulated process. DIY offers control but demands time and skill; traditional unit trusts add human advice but may carry higher fees. Choose the route you can stick with.

4) What do e-KYC and DuitNow change for me?

Faster, remote onboarding and near-instant funding/withdrawals—so monthly top-ups and opportunistic buys don’t stall.

5) Can I use EPF i-Invest—and when does it make sense?

If eligible, EPF i-Invest lets you direct a portion of Account 1 into approved funds online. It’s useful when you want clearer fee/track-record data and to manage retirement exposure alongside external portfolios.

Unlock Your Wealth Management with HWG Asia – Malaysia’s Leading Wealth Management Partner

You can always explore more at HWG!

HWG is a wealth management firm in Malaysia, offering wealth accumulation services tailored to Malaysian needs. From wealth advisory, estate and retirement planning to investment management, we provide expert advice and secure, personalized solutions that empower you to achieve wealth and financial security.

Whether you’re a young professional just starting to save and invest or a high-net-worth individual seeking advanced wealth strategies, HWG’s client-first model ensures that your goals are met with integrity and expertise.

Discover How HWG Can Help You Manage Your Wealth:

- Estate & Retirement planning solutions for every life stage.

- Investment management strategies are designed to maximize returns while managing risk.

- Ongoing support with regular reviews to ensure your plan evolves with you.

Contact HWG Malaysia Today:

Address: 29, Jalan SS 21/37, Damansara Utama, 47400 Petaling Jaya, Selangor

Email: customerservice@hwg.asia

Phone: 03-7732 6189

Inquiry: Contact Us

Visit HWG Malaysia’s Social Media Profiles:

Website: https://www.hwg.asia/

Facebook: https://www.facebook.com/hwg.asia

LinkedIn: https://www.linkedin.com/company/hwgasia/

Download the HWG Apps (available on the Play Store and App Store)!

HWG Hub: HWG Hub (For Internal Partner Use Only)

HWG Go: Coming soon

Disclaimer:

This article, published on this website, may be written or contributed by subject-matter experts or external writers. They are intended for general information and educational purposes only. HWG does not guarantee the accuracy, completeness, or timeliness of the information provided. Please note that the products, services or solutions in these articles may not be offered or provided by HWG. HWG shall not be held responsible or liable for any loss, damage, or issues arising from the use of, or reliance on such information.